How to Report Identity Theft

Identity theft occurs when someone uses another person’s sensitive personal information, Personally Identifiable Information, or Protected Health Information to commit, aid or enable fraud.

It is essential to keep your sensitive personal information, Personally Identifiable Information, and Protected Health Information safe and secure.

What is Identity Theft?

In today’s digital world, you are more likely to have your identity stolen than your car. As a Veteran, you have more to protect than the average citizen. It is essential to keep your sensitive personal information, Personally Identifiable Information and Protected Health Information safe and secure.

Identity theft occurs when someone uses another person’s sensitive personal information, Personally Identifiable Information, or Protected Health Information to commit, aid or enable fraud.

Examples include:

- Name

- Social Security number

- Date and place of birth

- Mother’s maiden name

- Telephone number

- Driver’s license number

- Credit card number

- Photograph

- Finger prints

- Biometric records

- Education

- Financial transactions

- Medical history

- Criminal or employment history

How Can I Tell if My Identity Has Been Stolen?

The good news is that if you notice the clues early, there are several ways you can minimize the damage and rectify the situation. The more vigilant you are about looking for warning signs, the harder it will be for identity thieves to get what they want.

Common identity theft warning signs include:

- Finding unexplained charges on your credit card bill.

- Receiving a notification for an account you did not open.

- Missing or not receiving your normal bills or other mail.

- Being denied credit for no apparent reason.

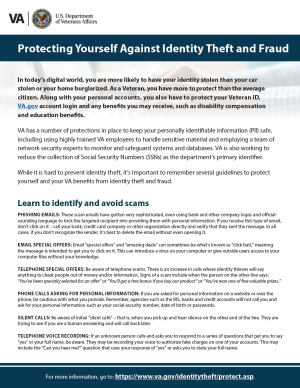

Identity Theft Prevention Tips

How to Report Fraud

Fraud is the intentional misrepresentation of information to gain undeserved payment.

Fraud is increasing on a global scale, changing the way businesses and individuals protect themselves and their data. Veterans are often targets of fraud, and fraudsters are becoming more sophisticated in their attacks.

To learn more about Veterans Fraud prevention, visit the Protecting Veterans from Fraud webpage.

Helpful Video

VA Privacy in Action Speaker Series Event:

Identity Theft Scams and How to Avoid Them

Wednesday, February 24, 2021 1:00 to 2:00 p.m. ET

This educational event featured experts from VA, U.S. Postal Inspection Service (USPIS), and Federal Trade Commission (FTC). This event provided helpful resources, lessons learned, and best practices on how to protect consumers against identity theft scams.

Documents

Click the links to open the full document. Use your browser to download the document to your desktop.

Additional Identity Theft and Fraud Resources

- Cybersecurity & Infrastructure Security Agency (CISA)

- Department of Homeland Security (DHS)

- Federal Bureau of Investigation (FBI)

- Federal Trade Commission (FTC)

- Internal Revenue Service (IRS)

- Social Security Administration (SSA)

- United States Postal Inspection Service (USPIS)